Distressed Auto Loans

While acquiring and servicing these notes will be similar to buying other loans, the repossession processes will be quite different.

When someone buys a car, they give the lender give the lender a security interest in the vehicle. Having a security interest generally means the lender can repossess the car without prior notice if the loan is in default. Taking possession of a car is less complicated and much quicker than property foreclosure.

Like with other notes, you do have options. You could buy the note and start collecting payments, or repossess the vehicle and resell it. While every state has different rules regarding repossession, a loan in default is usually enough cause to take possession of the vehicle.

How to Find Non-Performing Automobile Loans with BankProspector

This data works just like the other charts in our BankProspector software. You can select Auto Loans from the main banks page (or any state data page) to see the current national numbers.

This data works just like the other charts in our BankProspector software. You can select Auto Loans from the main banks page (or any state data page) to see the current national numbers.

From there you can filter by the current status of the loan to see a list of the banks holding this debt.

As always, when you click on one of these banks to view their full record, we'll show you the historical data for the banks auto loans. You can see how their loan health has changed over time, and use that to your advantage when trying to make a deal.

Of course we have also added Auto Loans filters to the Advanced Search. This is just another type of distressed asset you can target. A new tool to find smaller notes for your smaller investors. Or perhaps this is a whole new revenue stream for yourself!

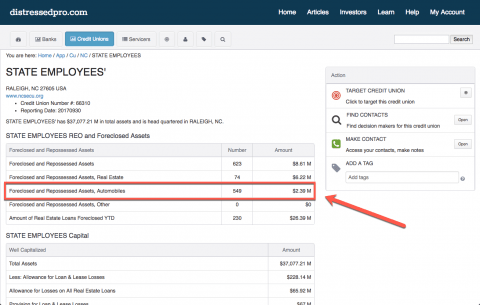

Repossessed Automobiles at Credit Unions

We've always had the repossessed automobiles numbers for credit unions. Thus far we haven't implemented searching or sorting for this asset type but if we hear interest from our subscribers then we'll certainly implement it.

We've always had the repossessed automobiles numbers for credit unions. Thus far we haven't implemented searching or sorting for this asset type but if we hear interest from our subscribers then we'll certainly implement it.